Practice Activity 9.16 A Limited Liability Company’s statement of profit or loss

- Adaeze Nwobu

- Apr 11, 2023

- 1 min read

Obi Oil Limited was incorporated in 2006. The company’s authorised share capital is ₦700,000 ordinary shares of 50 kobo each. Obi Oil Limited was established to manufacture and market refined petroleum products.

The company prepares its financial statements to 31 December annually. The following trial balance as at 31 December 2018 was extracted from the company’s accounts:

The trial balance continues as follows:

Additional information:

The cost of closing inventory as of 31 December 2018 is ₦34,000. The net realisable value of closing inventory is ₦38,900.

The provision for litigation claim was made for a court case. The provision is no longer required.

The income tax rate is 30%. At the year-end, there are temporary taxable differences of ₦4,500.

Dividends were declared and paid to amount to ₦2,151 during the year.

Required: Prepare the statement of profit or loss for the year ended 31 December 2018.

See the suggested answer to practice activity 9.16 here.

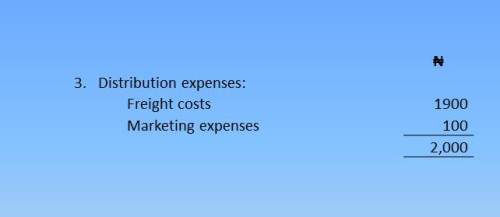

Suggested answer to practice activity 9.16

Comments