Practice Activity 9.10 Treatment of a non-current asset’s revaluation when an actual sale of the as

- Adaeze Nwobu

- Apr 11, 2023

- 1 min read

Practice Activity 9.10 Treatment of a non-current asset’s revaluation when an actual sale of the asset did not occur

The following information was extracted from the notes to the financial statement of Clear Water Company Limited as at 31 March 2019:

The depreciation for a building is 20% on a straight-line basis.

On 31 March 2019, the management of Clear Water Company Limited has decided to revalue the building to reflect current market realities. The revalued amount of building is ₦5,200,000. The estimated useful life of the building is five years.

Required: Post the revaluation of the building to the relevant ledgers for the year ended 31 March 2019.

See suggested answers to practice activity 9.10 here.

Suggested answers to practice activity 9.10

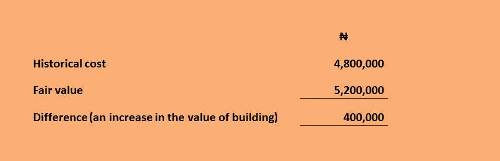

Step 1: Compare the historical cost and fair value of the building.

Step 2: Deduct the accumulated depreciation of building. The accumulated depreciation of building is ₦1,920,000.

Step 3: Ascertain the revaluation gain

The revaluation gain can be ascertained by comparing the carrying value of building with the fair value.

Step 4: Deduct the accumulated depreciation from the revaluation gain

Posting revaluation reserves in the accounts

Comments