Practice Activity 6.2 Double entry for insurance expense featuring an accrued element

- Adaeze Nwobu

- Jan 5, 2023

- 3 min read

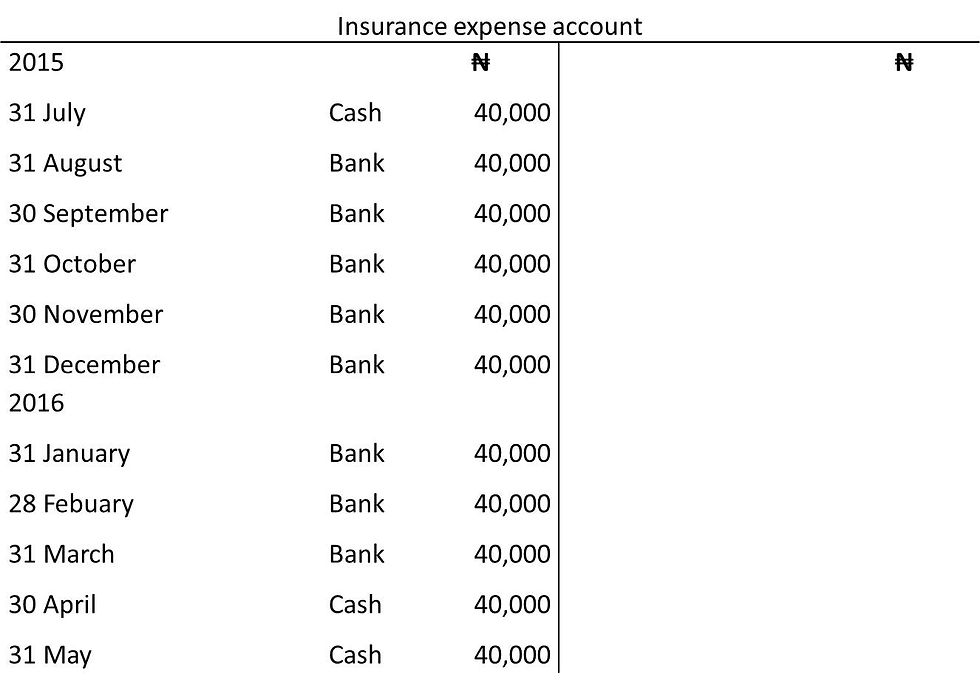

Annual insurance premium of ₦480,000 is payable in twelve equal installments on or before the last day of every month from July 2015. The accounting period of the business enterprise is from 1 July to 30 June. The premium was paid on before the due date from July 2015 to May 2016. On 31 July 2015, 30 April 2016, and 31 May 2016, the insurance expense payment was done using cash. The remaining payments were done through the business bank account. But in June, there was a delay between the time the insurance expense was due and the time the insurance expense was paid. The insurance expense of ₦40,000 for June 2016 was due on 30 June, and it was paid for on 10 July 2016.

Required: Show the double entry for the insurance expense in the relevant ledgers.

Suggested answers to practice activity 6.2

The double entry for insurance expense paid for is shown below:

Debit Insurance expense account

Credit Cash book (that is, the cash or bank column in the cash book)

The implication of the outstanding ₦40,000 which should have been paid on or before 30 June 2016 is that it will be accounted for using the accrual basis. Based on the IASB (2018, Conceptual Framework), accrual accounting shows the influence of rent expense on an entity’s assets (cash) and claims to the resources in the accounting period ending 30 June 2016 when the transaction occurs, notwithstanding that the cash payment for the rent expense will take place in a different period.

The accrual basis shows the effects of the insurance expense on the reporting entity’s cash and claims to the cash in the period (from 1 July 2015 to 30 June 2016) that those effects from owing insurance expense take place, even if the resulting cash payments for the insurance expense ensue in a different period. The business is expected to pay insurance premium every month including June 2016. However, the resulting cash payment for the insurance expense due on 30 June 2016 was done on 10 July 2016. This implies that the payment occurred in a different accounting period (1 July 2016 to 30 June 2017).

The statement of profit or loss should depict the effects of insurance expense in the period that insurance expense occurs (that is, for period ended 30 June 2016). The effect of insurance expense is that it reduces the gross profit by ₦480,000.

The insurance expense for the accounting year ended 30 June 2016 is ₦480,000. The insurance expense of ₦480,000 should be deducted from the gross profit in the statement of profit or loss for the period ended 30 June 2016.

The accounting year of the reporting entity ends on 30 June 2016. Look at the insurance expense account. Check the insurance expense paid for as of 30 June 2016. A close observation of the insurance expense account shows that the most recent insurance expense of ₦40,000 was paid for on 31 May 2016.

Then, post the actual insurance expense of ₦480,000 to the profit or loss account.

An attempt to balance the insurance expense account shows that ₦40,000 is outstanding from the actual insurance expense of ₦480,000. The outstanding insurance expense of ₦40,000 should be termed ‘accrued c/d’.

The accrued c/d represents an accrued expense. Accrued expense b/d is on the credit side of the insurance expense account. This implies that insurance expense of ₦40,000 is yet to be actually paid for as of 30 June 2016.

Accrued insurance expense is a liability. Since the insurance expense for June 2016 is paid on 10 July 2016, the ₦40,000 is an amount falling due within the next one year (current liability). Remember the elements of financial statements.

Comments