Practice Activity 5.3 Double entry effects of transactions

- Adaeze Nwobu

- Dec 29, 2022

- 2 min read

Updated: Dec 30, 2022

The facts are the same as Practice Activity 5.1.

Required: Show the double entry effects of each transaction in the respective accounts.

Suggested answers to practice activity 5.3

Transaction i: The business owner introduces ₦356,000 cash into the business on 3 March 2017.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction ii: On 10 March 2017, the business buys inventory from the market for ₦57,000. This amount was paid in cash.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction iii: The business sold inventory for ₦35,000 on 15 March 2017. The amount was paid in cash.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction iv: The business bought furniture using cash for ₦36,000 on 16 March 2017.

The debit entry posting is as follows:

The corresponding credit entry is as follows:

Transaction v: Salary amounting to ₦10,000 was paid to the business owner on 31 March 2017.

The debit entry posting is as follows:

The corresponding credit entry is as follows:

Transaction vi: On 20 March, the business was supplied inventory amounting to ₦38,000 by Supplier Enterprises, and the business did not pay cash for the supply.

The debit entry is as follows:

The corresponding credit entry is as follows:

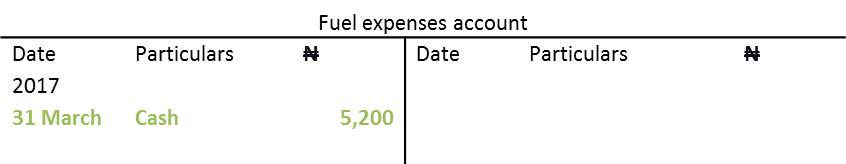

Transaction vii: Fuel expenses of ₦5,200 was paid by cash on 31 March 2017.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction viii: The business paid cash of ₦110,000 into its bank account, which was opened on 31 March 2017.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction ix: On 31 March 2017, the owner’s uncle, Mr. Gift, gave the business a loan of ₦40,000. The loan was provided by cheque.

The debit entry is as follows:

The corresponding credit entry is as follows:

Transaction x: The electricity bill of ₦8,800 was paid using bank transfer on 31 March 2017.

The debit entry is as follows:

The corresponding credit entry is as follows:

Comments